ADA Price Prediction: Navigating Bearish Technicals and Bullish Catalysts

#ADA

ADA Price Prediction

ADA Technical Analysis: Bearish Signals Dominate

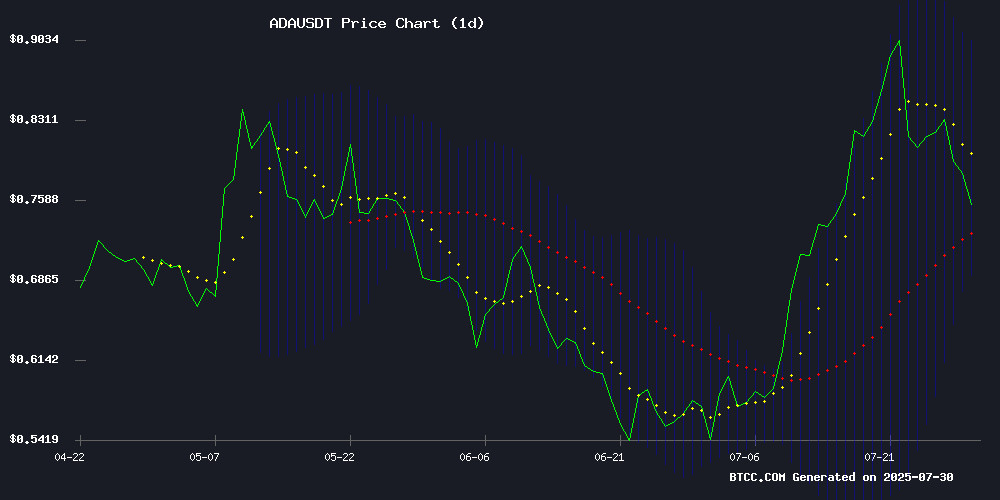

Cardano (ADA) is currently trading at $0.7682, below its 20-day moving average of $0.7976, indicating bearish momentum. The MACD histogram shows a slight positive crossover at 0.0276, but remains DEEP in negative territory (-0.0739 signal line). Bollinger Bands show ADA testing the lower band at $0.6921, suggesting potential oversold conditions.

"The technical picture shows ADA struggling to regain bullish momentum," said BTCC analyst Mia. "While the MACD shows tentative signs of reversal, traders should watch for a sustained break above the middle Bollinger Band at $0.7976 to confirm any trend change."

Mixed Signals for ADA Amid Market Turbulence

Market sentiment around Cardano appears conflicted, with bullish airdrop news contrasting with technical weakness. The upcoming Midnight Glacier airdrop offering 50% allocation to ADA holders provides potential upside, while Telegram traders speculate about 100x opportunities in the ecosystem.

"The airdrop news could provide temporary support," noted BTCC's Mia. "However, the dominant seller activity and resistance levels mentioned in market reports suggest any rallies may face headwinds. Investors should weigh these opposing factors carefully."

Factors Influencing ADA's Price

Telegram Trader Identifies Potential 100x Crypto Opportunity Amid Cardano's Struggles

A prominent Telegram trader has flagged an emerging crypto project as the next potential 100x opportunity, drawing parallels to Cardano's historic 2021 rally. The unnamed analyst highlights Unilabs' presale momentum—$7.1 million raised at $0.0085 per token—as evidence of speculative fervor reminiscent of ADA's 1,200% surge during its smart contract debut.

Cardano's current trajectory paints a contrasting picture. Despite the Alonzo Upgrade's past success, ADA trades 74% below its $3.10 peak at $0.8038, with analysts warning of further downside. The network's fundamental progress appears decoupled from price action as broader market headwinds persist.

Market participants increasingly bifurcate between chasing presale gems like Unilabs and weathering established assets' volatility. This dichotomy underscores crypto's high-risk, high-reward paradigm—where yesterday's winners become today's consolidation plays, and obscure tokens inherit the growth narrative mantle.

ADA Holders to Receive 50% Allocation in Upcoming Night Airdrop via Midnight Glacier

Cardano founder Charles Hoskinson has confirmed an early August announcement for the Midnight Glacier Drop, a highly anticipated token distribution event. The airdrop will allocate half of its tokens to ADA holders, reinforcing Cardano's commitment to community rewards.

The Night Airdrop initiative through Midnight Glacier represents Cardano's latest effort to enhance ecosystem participation. Market observers note such distributions often precede periods of increased network activity and valuation pressure.

Cardano (ADA) Faces Resistance as Sellers Dominate Market Action

Cardano's ADA struggles to maintain momentum after failing to breach the $0.90 resistance level. The digital asset has retreated to $0.80, with sellers now controlling the price action. Market observers note this support level could provide a springboard for buyers, though it remains weaker than the more substantial $0.64 floor.

The current pullback reflects typical market volatility rather than structural weakness. A sustained hold above $0.80 WOULD signal bullish potential, potentially enabling a swift retest of the $0.90 ceiling. However, further declines toward $0.64 would likely prolong the consolidation phase before any meaningful recovery.

Trading volume tells a concerning story, with buyer interest waning significantly in recent sessions. The volume profile shows clear seller dominance, suggesting diminished enthusiasm for ADA in the short term. Market participants await confirmation of whether the $0.80 support can stem the tide and reignite demand.

Is ADA a good investment?

ADA presents a complex investment case at current levels. The technical indicators show bearish dominance, while fundamental developments offer potential catalysts. Consider these key factors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.7682 | Below key MA levels |

| 20-day MA | $0.7976 | Immediate resistance |

| MACD | -0.0739 | Bearish but improving |

| Bollinger Bands | $0.6921-$0.9031 | Testing lower range |

"Risk-tolerant investors might find current levels attractive for dollar-cost averaging," suggests Mia. "However, conservative traders may want to wait for confirmation of trend reversal above the $0.80 psychological level."

- Technical Weakness: ADA trades below key moving averages with bearish MACD signals

- Potential Catalysts: Midnight airdrop and ecosystem developments could boost sentiment

- Market Sentiment: Mixed signals between seller dominance and speculative interest